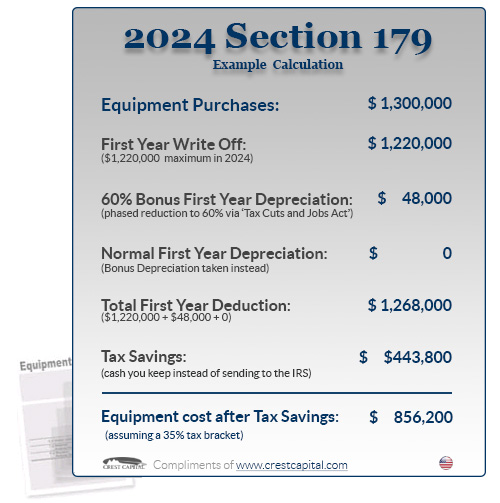

Section 179 Deduction 2025 Vehicles – The deduction on such vehicles was capped following controversy over some business owners essentially buying luxury vehicles for personal use and writing off the full cost under section 179. . Some further snooping reveals that in addition to the vehicle, the business the maximum Section 179 deduction was $17,500. In 2025 that limit will be $1,220,000. Admittedly most small .

Section 179 Deduction 2025 Vehicles

Source : www.section179.orgMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comUpdate] Section 179 Deduction Vehicle List 2025 | XOA TAX

Source : www.xoatax.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

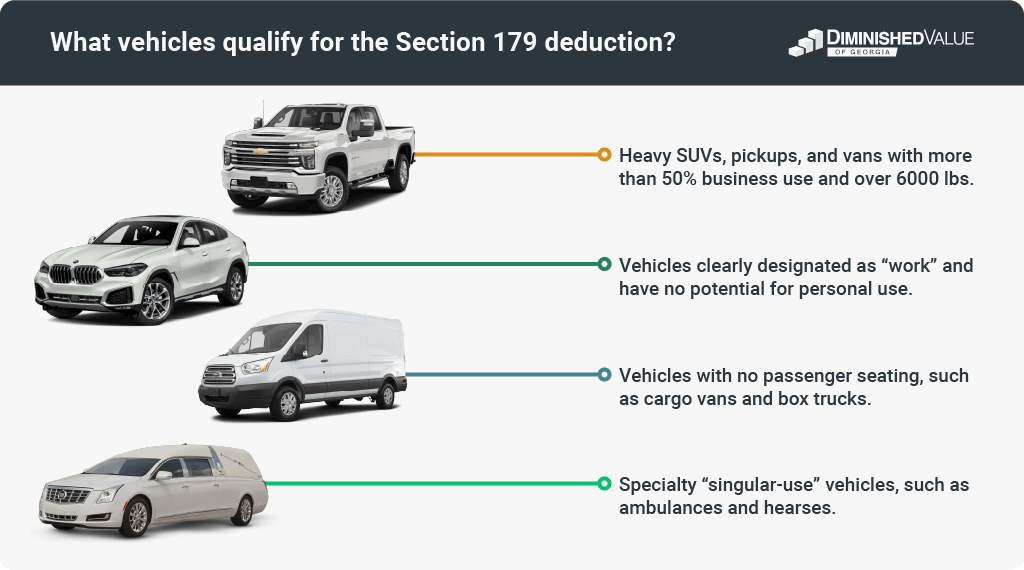

Source : diminishedvalueofgeorgia.comSection 179 Eligible Vehicles at Bob Moore Auto Group

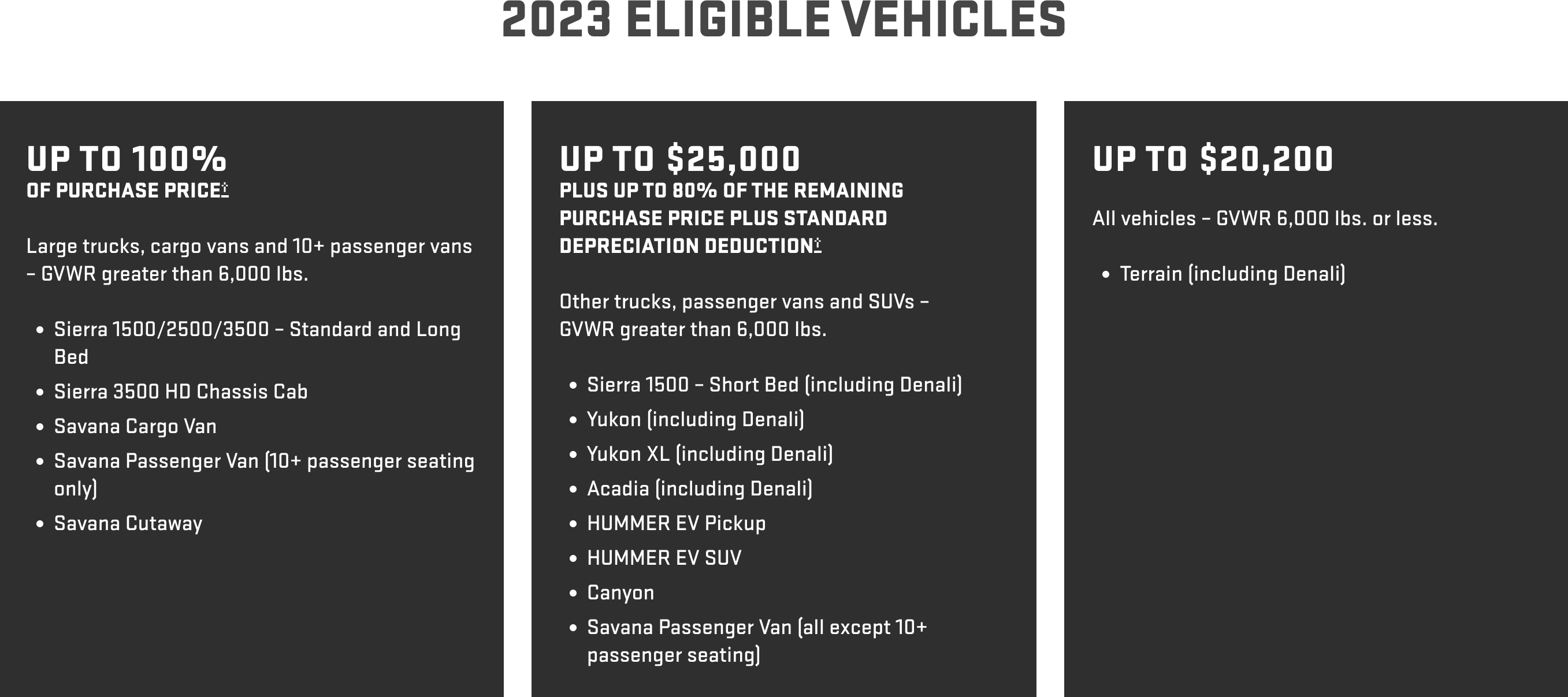

Source : www.bobmoore.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comSection 179 Vehicles For 2025 Balboa Capital

Source : www.balboacapital.comUpdate] Section 179 Deduction Vehicle List 2025 | XOA TAX

Source : www.xoatax.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comHyundai Section 179 Rules & More | Hyundai Dealer Near Me

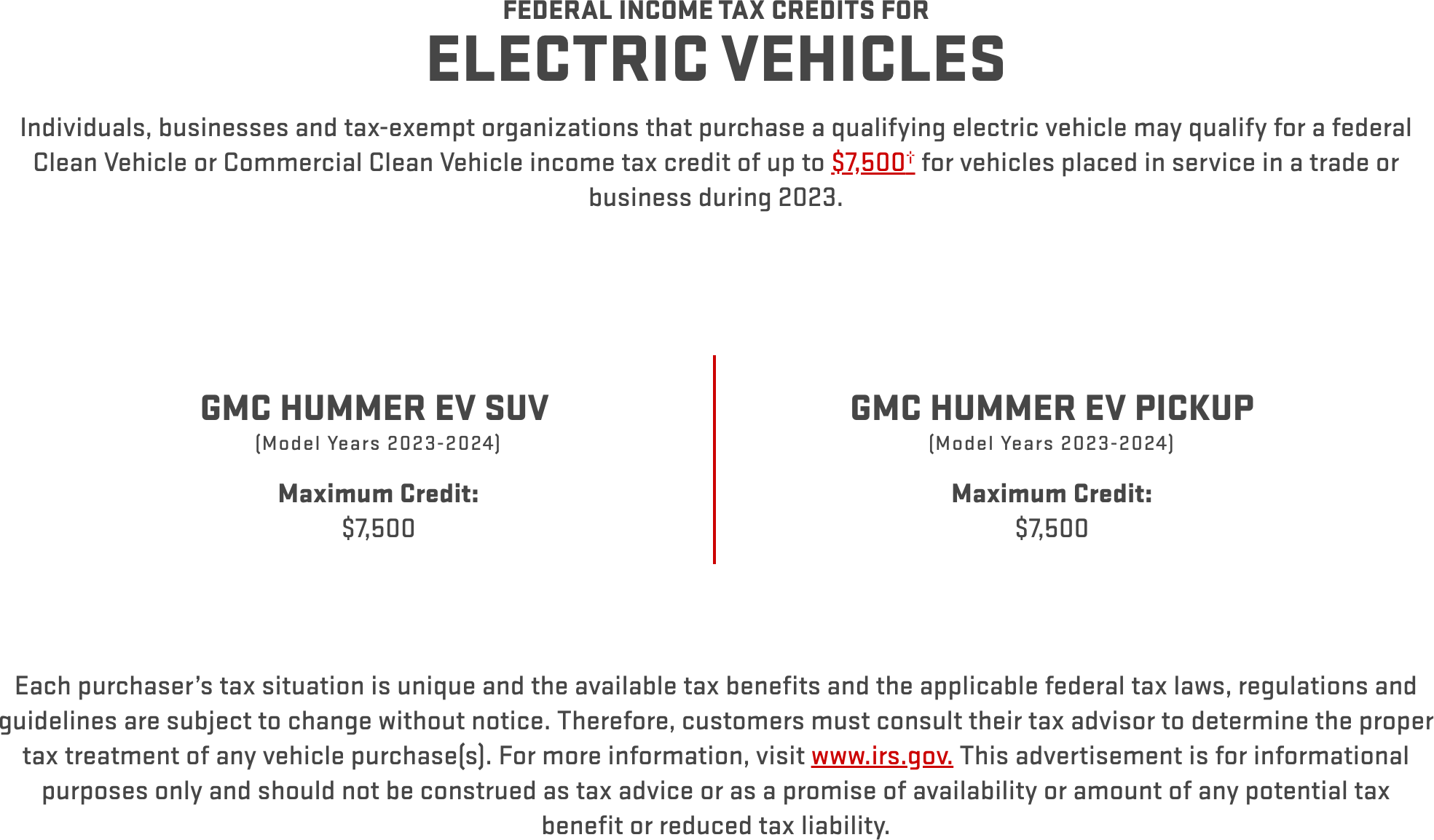

Source : www.northparkhyundai.comSection 179 Deduction 2025 Vehicles Section 179 Deduction – Section179.Org: precious few vehicles qualify for a total deduction — if your heavy truck is at all practical for normal daily use, it probably doesn’t count. From Section179.org: Business Vehicles for Full Section . Section 179 is a federal rule intended to help small and medium-sized businesses by allowing them to receive specific tax benefits sooner if they choose to do so. If you purchase assets for your .

]]>